NOTICE OF LIEN SALE OF PROPERTY FOR NON-PAYMENT OF TAXES,

ASSESSMENTS AND OTHER MUNICIPAL CHARGES

THE BOROUGH OF ENGLISHTOWN, MONMOUTH COUNTY, NEW JERSEY

PUBLIC NOTICE IS HEREBY GIVEN THAT I, Consetta Ellison, Collector of Taxes, in the Borough of Englishtown, County of Monmouth, State of New Jersey, pursuant to the provisions of “Act concerning unpaid taxes, assessments, other municipal and utility charges on real property and providing for the collection thereof, by the creation and enforcement of liens thereon (revision of 1918 Title 54:5-19 Revised Status)” will sell at public venue, all the land and real estate mentioned in the following lists, in fee subject to redemption at the lowest rate of interest, in no case exceeding 18% per annum, for the purpose of making the amount chargeable against said land for taxes, interest and cost to date of sale, on which taxes and/or other municipal charges remain unpaid for the year 2024 in an Accelerated Sale as requested by the governing body in resolution 2024-141.

In the event that the owner of the property is on active duty in the military service, the tax collector should be notified immediately.

The sale will take place at the Borough of Englishtown, Municipal Court Room, 15 Main Street, in said Borough on Thursday December 12, 2024, at 10:30 A.M.

Purchasers will be required to pay by certified check or money order for the municipal liens chargeable against each parcel of land purchased by them prior to the conclusion of the sale, or the property will be resold.

Certificate purchasers are herewith advised, pursuant to N.J.S.A. 13:k-6, that industrial property may be subject to the “Environmental Clean Up Responsibility Act”, the “Spill Compensation and Control Act”, or the “Water Pollution Control Act”. These laws preclude the municipality from issuing a Tax Sale Certificate to any purchaser who is or may be in any way connected to the previous owner or operator of such sites.

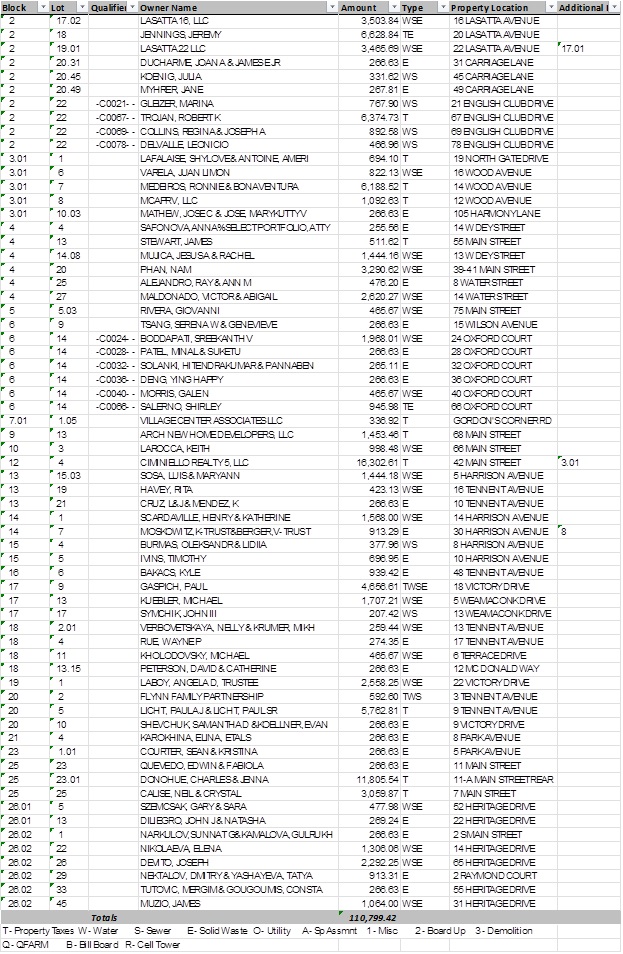

The following is a list describing the land to be sold, owner’s name and the total amount due thereon as computed to the date of sale.

CLICK HERE

CLICK HERE